Wearable tech has become increasingly common in recent years with the fitness band and watch boom playing a key role. According to a report published by famed research company IDC, India’s wearable market grew by around 170.3% on a year-over-year or YoY basis in Q1 of 2021, shipping around 11.4 million units. Amidst this rise, watches grew by 463.8% YoY in Q1 2021 to become the fastest-growing category when it comes to wearables. The segment, consisting of wrist bands and watches rose by a whopping 74.8% YoY this quarter. In contrast, the earwear category rose by 209.3% YoY to reach 9.3 million shipments in Q1. As per the data, Noise was able to maintain its position at the top of the watch sales chart in the last quarter, accounting for 25.7% of the India market, with fellow Indian brand BoAT accounting for 21.9% of the market share. Both of them being local brands hint at India’s booming watch market. Overall, the shipments of watches rose to 1.4 million in Q1 with higher demand for low-cost products.

Was There Demand For Other Categories?

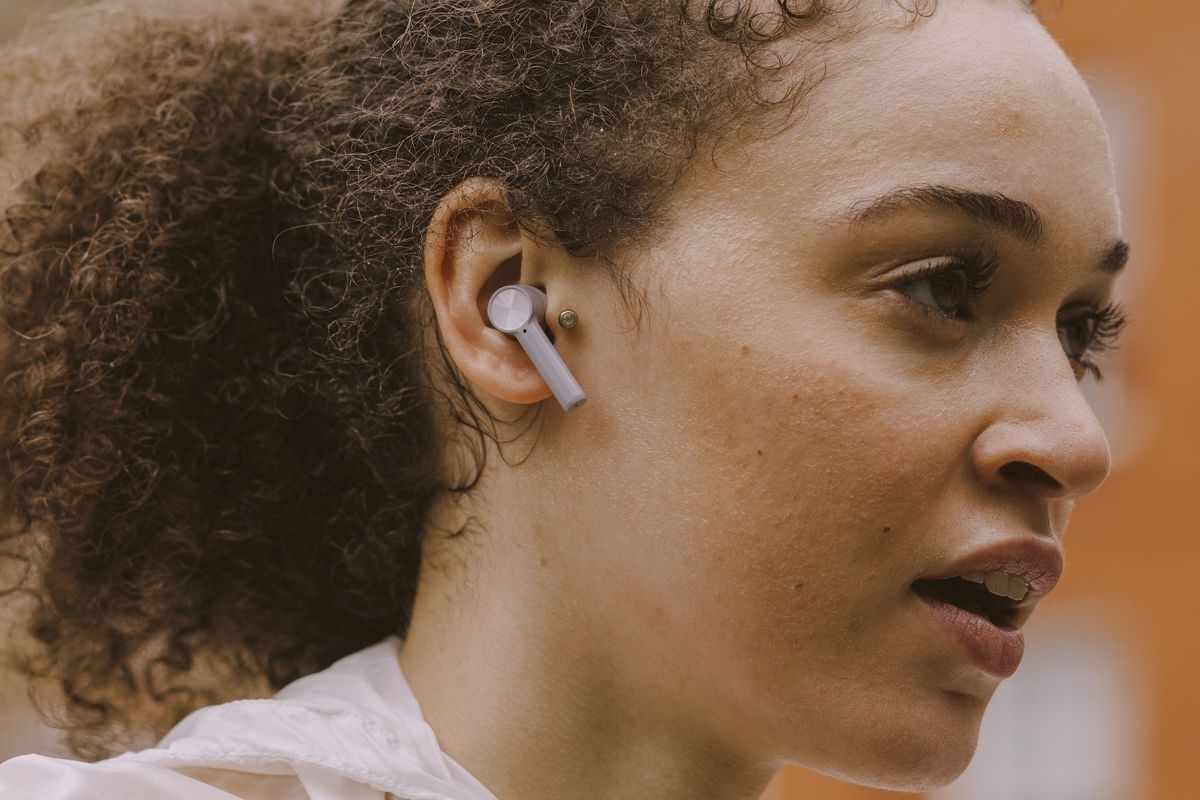

When it comes to wristbands, Xiaomi took the crown with a market share of 37.3 % in the last quarter. OnePlus, which recently launched its first band captured the second spot swapping places with Realme with a 25.2 per cent market share. In terms of the earwear segment, it grew by 209.3 per cent YoY with 9.3 million shipments in the first quarter of the year, with BoAt leading the overall earwear segment with a 29.3 per cent share with OnePlus playing second fiddle with a 15.1 per cent share. The TWS or Truly Wireless Stereo category grew by 284.4% YoY with a 35% share in the overall earwear segment. BoAt remained on top with a 25.6% share with OnePlus in second with a share of 11.9% due to the OnePlus Buds Z’s sales. Do note that the overall shipments for wearables fell by 24.9% in Q1 of 2021 due to a drop in earwear shipments. The cause for the decline can be pinpointed as leftover inventory due to a lack of fresh sales. Anish Dumbre, Market Analyst, IDC India stated that the ongoing consumer enthusiasm when it comes to earwear devices is an indication of the category’s healthy appetite. Vendors are now trying to capitalize on the ride by offering low and mid-priced devices. This not only helps lower the category’s ASP but also adding improved features to acquire new users.